News & Articles

Buying an individual disability insurance policy could make sense if your employer does not offer coverage, if the disability coverage offered through your employer is limited, or you are self-employed. Employer-sponsored [group] disability insurance usually pays only a portion of your base salary, up to a cap. It is a good idea to supplement your existing group coverage if:

- your salary far exceeds the cap on the group coverage

- you depend on bonuses, commissions, or additional shifts above a base schedule, as may be the case for health care professionals.

Short-Term VS. Long-Term Disability coverage

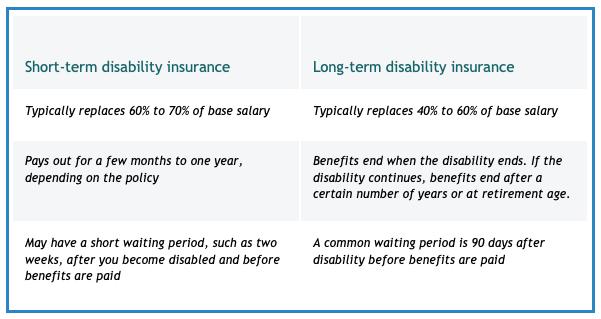

There are two main types of disability insurance — short-term and long-term coverage. Both replace a portion of your monthly base salary up to a cap, such as $10,000, during disability. Some long-term policies pay for additional services, such as training to return to the workforce.

Advantages of Individual Coverage

Buying your own policy allows you to:

-

Customize your coverage by selecting extra features (a/k/a “riders”) such as such as Future Increase Options that allow for increases in coverage as your income grows. The younger you are when you purchase your policy, the more valuable such riders will be to you.

-

Choose an insurance company with the best offerings for the terms most important to you.

-

Keep the coverage when you change jobs. Group disability coverage ends when you leave an employer who is paying the premiums for your disability insurance.

-

Maintain and control the disability insurance. Individual disability coverage stays intact as long as you pay premiums. In contrast, an employer can decide to change or stop offering group disability coverage as part of its benefit package.

-

Collect benefits tax-free if you become disabled. If the employer pays for the coverage, you must pay taxes on the benefits.

Cost of Insurance

Insurers set their premiums using claims data associated with a variety of factors that make up the applicant’s profile. Your profile will determine the cost of your coverage and includes:

- Your age and health: You will pay more the older you are and the more health problems you have.

- Your gender: Premiums for women are generally higher because data shows they tend to file more claims than men.

- Your annual employment income: The annual price for a long-term disability insurance policy generally ranges from 1% to 3% of your annual income, according to the Council for Disability Awareness.

- Whether you smoke: Your premiums will be higher if you smoke.

- Your occupation: You will pay more for a policy if you work in a job associated with high risk of injuries.

- The definition of disability you choose: The broader the definition of disability, the higher the premium. A policy that covers you if you can’t work in your own occupation will have higher premiums than a policy that provides coverage if you can’t work anywhere.

- Length of waiting period: Known also as the elimination period, this is the time from the start of disability until policy benefits kick in. Elimination periods run from 30 days to 6th months or longer, although 90 days is the most commonly chosen period.

- Your income: The more income you have to protect, the more you’ll pay for coverage

- Length of benefits: The longer the period that the policy promises to pay out if you become disabled, the higher your premiums will be.

- Additional features – Riders – that you choose to customize your policy will usually increase your premiums as well, although some automatic riders may be included free.

Riders

While most terms of a disability contract are standard, riders allow you to tailor your coverage to address risks such as inflation or residual injury.

Without some type of protection, inflation can seriously erode the purchasing power of your long-term disability benefits. Three common disability insurance riders help minimize the risk of inflation by increasing your coverage over time.

- The Future increase option allows you to protect your future earnings by locking in/ guaranteeing additional coverage up to a certain age (normally age 55). While you will be asked to provide a copy of your most recent tax return to prove your new income level, you can increase your monthly benefit regardless of age or any health changes without additional medical underwriting.

- The Automatic Increase Rider increases your total monthly benefit each year for a set number of years – generally, about a 25% increase in coverage over five years. The idea is to have your coverage increase with inflation over time without you having to pay attention to it.

- The Cost Of Living rider can help minimize the effect of inflation on your future purchasing power. But when you choose this option, your benefits will be adjusted upward as inflation rises (as measured by changes in the Consumer Price Index). This rider only kicks in once you go on a disability insurance claim, and then only if the disability lasts for more than one year. Depending on the percentage option you elected when you took out the policy, it will increase your monthly benefit every year along with the CPI while you are on a claim, up to the maximum you elected. It is quite often the most expensive rider available on a disability insurance policy and is generally recommended for applicants under the age of 42 whose financial situation would be devastated by a disability.

Residual Benefit

A large percentage of claims start or end as a partial or residual injury affecting the number of hours the insured is able to work, the duties the insured is able to complete, and therefore the income the insured is able to earn. The Residual Benefit Rider pays you a partial benefit in the event you suffer a partial disability or do not recover fully from a disability. The percentage of your benefit paid is typically proportionate to your loss of income. This feature commonly triggers a benefit at 20% loss of Income due to illness or injury.

Renewability

We rely on insurance to protect various aspects of our financial lives, so policy guarantees are important. There are three types of renewability options for disability insurance, but there is only one safe choice: Non-cancellable Guaranteed Renewable.

- Non-Cancellable Guaranteed Renewable terms guarantee that once your policy is in-force the insurer can only change your premium schedule, monthly benefits, or policy benefits to age 65 or a certain age with your agreement, for as long as you pay the premiums when due. In other words, the insurance company legally cannot change a thing without your consent. Even if a new job results in a lower income, you are entitled to the total disability benefit you originally placed in-force. If, on the other hand, your income increases, and you exercise a Future Purchase Option, you will likely have to agree to an increase in premiums. Regardless, this renewability option is the clear choice.

- Guaranteed Renewable allows the carrier to change the premium by state, policy year, or occupational class with approval from the state.

- Conditionally Renewable essentially provides you no protection.

Checklist for Reviewing Disability Policy Features

- Critical features: Own Occupation coverage that is Non-cancellable Guaranteed Renewable with Future Increase Option and Residual Benefits.

- Monthly benefit amount is the amount of income you would need to replace if you became disabled.

- Elimination period is the length of time you could reasonably wait upon suffering a disability for benefits to kick in. Look for a policy that allows this period to be satisfied by both residual and total disability. 90 days is a typical elimination period.

- Benefit period is the length of time you want the policy to last. Your options will be a term of years or a specific age, such as 65 or 67 (generally the maximum age on a policy.)

- Policy exclusions to watch for include exclusions or limitations on length of coverage for disability due to mental/nervous disorders and alcohol and drugs. More common exclusions are for acts of war and disability incurred in the act of a felony.

Shamrock Wealth Management is located at 991 Sibley Memorial Highway, Suite 201, Lilydale, MN 55118. Ardis Black can be reached at 651-317-4330 (Office) or 651-428-3715 (Cell.) Securities and Advisory Services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Advisor.

© 2020 Ardis L Black

© Copyright 2020 | Shamrock Wealth Management | All Rights Reserved